You are not a representative sample.

This is a great example of how we can use statistics to say whatever we want.

Food IS more expensive. And yet we DO spend a smaller percentage of our income on food.

Maybe we’re spending more of our income (way more) on other things that we weren’t before. Or on what we weren’t ever spending on before. (How many families had 2 cars 75 years ago? Or even one??)

Isolating one data point and arguing over different facts about it is just a wasteful exercise in bickering.

We spend half as much of our monetary expenditures on food as we did 50 years ago. Half.

That’s part of what allows us to spend it on “other things”. Because in aggregate we are far richer than we were, have far more disposable income than we did, can afford to buy houses that are twice as large and buy twice as many cars. Eat out far more often.

I don’t think it’s an “isolated data point”. I think it’s an acknowledgment of the overwhelming economic success of the post-WW2 US economy.

Totally the key point here, IMO.

This side discussion came out of the suggestion that increased demand raises prices.

The key point you make shows how we are able to accommodate the increase in prices. It doesn’t show that prices have not risen.

Cost of food is an isolated data point.

It exists in a sea of 1000 other consumables, in an ocean that varies in depth by disposable income.

The “key point” is that an increase in demand does not automatically lead to an increase in prices, and that’s not what has happened with food in the US.

Food prices haven’t risen:

I don’t think you can say that.

yes I am.

The average family of 4 earns 87k, thats $1673. After taxes, 401K’s insurance what they take home would be somewhere between 900 and 1200 depending on how they are saving and insurance cost. call it 1100. 13% of that is $143. $143 is more like 1/2 of what a family of 4 would have to spend on groceries and that doesn’t include eating out, steaks or crab legs. Just basics.

BLS is looking at lifetime averages and comboning rich and poor and middle class. (Each of these are proper thigns to do.)

If you never own a home, or never pay one off,

you are going to spend a large portion of you income on shelter

(over 50% is common for young people.) and thus a SMALL portion on food.

If you buy a home and stay there a while, the monthly PITI payent eventually becomes qute small, you eat ut alot and spend a LARGE portion of you income on food.

Do the same for rich vs poor and it becomes clear —> 12.9% is probably a gogod average because for a lot of people its twice that and for a lot of people it is half that.

Nominal food prices have increased less than:

The CPI

Incomes

PCE

Food prices are a smaller share of budget today than they were in <insert a year in the past here)

The opportunity cost of purchasing food is lower today than it was in

The productivity gains in food production have led to food being a far smaller burden on the average household budget today than it was in

An hour of labor today will buy more food than it did in

All of those are true, and all are synonymous with food being less expensive today.

all yyou have to look at is the average family of 4. Average income (the median is only 78K, the average 87K. Take home pay around $1100. $143 a week for groceries would have them starving

but income is not wages.

Wages is a tiny subset.

But consumer items generally have outpaced wages.

this definitley includes shelter costand probably includes food cost

(wages are not incomes. Income included stock market earnings, business income, the earning of the super rich etc. The proper comaparison to make is not to that super-broad all-inclusive category called “income.”)

.

.

.

.

EX:

Wages rise from $1 to $2

but if we count what the boss pays for your healthcare,

your total income rose

- from $1 cash plus $1 healthcare

- to $2 cash plus $10 for healthcare, because helathcare costs are out of control.

Seeing this and declaring “food prices went down” is illogical.

(Gee if we just make healtcare costs go up enough we will solve world hunger!)

I don’t think that’s true at all. Wages have grown faster than the CPI. That’s why today, wages buy more than they did 50 years ago (larger homes, more cars, more food, more electronics, more clothes.)

The average middle income family in the US spends less on food than they did 50 years ago, they but more cars, more houses, more clothes, more of just about everything except candlesticks and Atari 2600s (which is unfortunate, actually)

thats just false. I did the math for you above. Unless you think the average family of 4 can eat well on $143 a week for groceries (which they cannot) then 13% is not a real number

(nonsupervisory) wages are exactly precisely what my v-shaped chart above tracks.

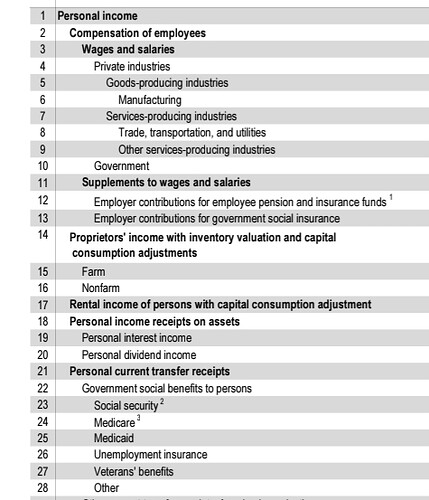

This is what is included in “personal income.” It is a term > wages

and < income

Yes, Ben, The BLS is lying and you know the truth.

Alrighty then.

Math doesn’t lie.

$143 a week will not buy groceries for a family of 4

The BLS just makes stuff up. Or maybe just maybe, you don’t understand it.

yes, they show current wages higher than 50 years ago - though I never limited my definition to some subset of wages. that was your choice.

I understand what income is just fine.

Waged and income have grown faster than the CPI - leaving aside the fact that the CPI is the wrong deflator for this conversation anyway because the CPI significantly overstates the change in purchasing power your typical consumer experiences over long periods of time.

I agree with it all true, but not with this:

I understand it fine. Statistics say what you want them to. Does not change the facts.

Average income for a family of 4 $87000

Take home pay approximately $1100 per week

13% for food = $143 per week (and some skinny malnourished kids).

Median income for a family of 4 $77700

average take home pay around $1000

13% for food = $130 a week for food (one kid ain’t gonna make it)

My wife and I alone spend near $200 a week if not more. (in fact, it is more- like around $230) We eat out about once every 2 weeks and that costs $60 on average. And we don’t eat steak and seafood every night. In fact, I get one steak each week and my wife one cod filet. That alone runs around $45. If we decide to go out for breakfast on Sunday… another $25-30. Buy a couple burger at a drive through? $20-25 (if you want fries and a drink).

13% my ass